Affordable Care Act

Why is Health Insurance so Expensive?

Updated on June 05, 2024

Share

Many middle-income Americans are having a difficult time affording their Obamacare premiums.

In a recent study conducted by the Kaiser Family Foundation (KFF) found that while premiums for ACA marketplace plans have steadily increased. In 2023, the typical annual health insurance premiums amount to $8,435 for single coverage and $23,968 for family coverage. These average premiums experienced a 7% rise in 2023 alone. Notably, the average family premium has seen a 22% increase since 2018 and a 47% increase since 2013.

According to healthcare.gov, employer-sponsored coverage is deemed “affordable” in 2023 if it costs less than 9.12% of household income.

Why Does healthcare cost so much?

How much does health insurance cost? There are a number of factors that influence how expensive health insurance is for individuals and their families. Administrative costs, rising prescription drug costs, and lifestyle choices all play a factor in ballooning healthcare expenses. While some of these factors are not in your control, others are. Find out where you can make a difference, not only in health insurance costs, but also to your overall health.

Healthcare system complexity

The complexity of the healthcare system plays a significant role in driving up insurance costs. With a multitude of healthcare providers, insurers, regulations, and billing practices, navigating the system can be incredibly intricate. This complexity often results in administrative inefficiencies, increased paperwork, and higher operational costs for both healthcare providers and insurers. These added expenses are eventually passed on to consumers in the form of higher insurance premiums, deductibles, and copayments. Additionally, the convoluted nature of the healthcare system can lead to misunderstandings, delayed claims processing, and disputes, further contributing to the overall rise in healthcare costs and insurance premiums.

Technological advances

Recent technological advances have significantly influenced health insurance prices, reshaping the landscape of healthcare coverage. On the positive side, these advancements have improved the efficiency of the healthcare industry by streamlining administrative processes and reducing paperwork, leading to cost savings for insurance companies. Telemedicine, facilitated by technology, has made healthcare more accessible and cost-effective, potentially decreasing the frequency of costly in-person doctor visits and, in turn, lowering overall healthcare expenses and insurance premiums. Advanced data analytics and predictive modeling have allowed insurers to gain better insights into health trends and risks, enabling them to develop more targeted and cost-effective coverage plans.

However, there are negative impacts to consider as well. High-tech medical procedures, while offering cutting-edge treatments, can be expensive, leading insurers to adjust their premiums to cover the costs associated with these advanced treatments. Additionally, the increased use of electronic health records and online services has necessitated substantial investments in cybersecurity measures to protect sensitive patient information. These investments can contribute to higher operational costs for insurers, which may, in turn, affect premiums. In summary, technological advances have the potential to both lower and increase health insurance prices, with the overall impact depending on how these developments are managed and integrated into the healthcare system.

Administrative overhead

Administrative costs are on the rise. This is partially due to new rules put in place by the Affordable Care Act. The U.S. healthcare system has separate funding sources, rules, out-of-pocket cost, and enrollment dates for various private and public insurance providers. Not only that, but consumers have to wade through complex tiers of coverage to choose a provider that will handle all their health care needs.

The rules are so complicated, it takes many people to process insurance claims, verify them, and pay them out. Medical billing professionals have to understand deductibles, coverage, and copays for numerous insurance companies. The training and compensation for these professionals translate into higher premiums and healthcare costs.

Rise of prescription drug costs

Americans pay an average of about twice as much for prescription drugs as those and other modern nations. The high cost of drugs is largely accountable for rising health care expenses in the country. In Europe, the government regulates drug prices based on the benefit they provide to patients. By contrast, American companies often charge much higher prices for drugs than it costs to produce them. This is largely due to the high cost of testing and approval required for drugs before they release them to the public.

Aging population

The phenomenon of an aging population, often referred to as a “graying nation,” carries significant financial implications for societies around the world. As people live longer and birth rates decline, the demographic composition of many countries is shifting towards an older population structure. While this demographic shift is a testament to improved healthcare and quality of life, it presents several financial challenges:

- Increased Healthcare Costs: One of the most immediate and noticeable financial implications of an aging population is the rising demand for healthcare services. Older individuals tend to have more healthcare needs, including treatments for chronic conditions, surgeries, and long-term care. This places a substantial burden on healthcare systems, driving up costs and necessitating higher spending on medical infrastructure and personnel.

- Pension and Social Security Systems: As more individuals reach retirement age and start drawing from pension and social security systems, the strain on these programs intensifies. Maintaining sustainable retirement benefits for an increasing number of retirees often requires adjustments in funding mechanisms, including potentially raising retirement ages or taxes to support these programs.

- Workforce Challenges: An aging population can lead to labor force shortages, which can have adverse effects on economic productivity. As older workers retire, there may not be enough younger workers to replace them, potentially hampering economic growth. Additionally, employers may face increased healthcare costs for their aging workforce, impacting labor costs.

- Economic Growth and Taxation: A larger elderly population may result in reduced consumer spending and slower economic growth, as older individuals tend to spend less than younger ones. Additionally, the tax base may shrink, as retirees typically have lower incomes, potentially leading to lower tax revenue for governments.

- Long-Term Care Expenses: The need for long-term care services, such as nursing homes and assisted living facilities, is likely to surge with an aging population. These services come at a significant financial cost for individuals and families, which can deplete savings and assets.

- Infrastructure Investments: Aging populations may require adjustments to infrastructure to accommodate the needs of older citizens, such as accessible public transportation, age-friendly housing, and healthcare facilities. These investments can strain public budgets.

To address these financial challenges, policymakers, healthcare systems, and individuals must proactively plan and adapt to the realities of an aging population. Strategies may include implementing reforms in healthcare delivery, modernizing pension systems, encouraging longer workforce participation, and fostering innovation in elderly care services. Effectively managing the financial implications of a graying nation is a complex endeavor that requires a comprehensive and forward-thinking approach.

Lifestyle choices

Lifestyle choices also play an important part in the cost of healthcare. Unlike administrative and prescription drug costs, you have some control over this factor. Unfortunately, many Americans make poor lifestyle choices that affect their healthcare and insurance costs. This is one of the reasons why the costs associated with health insurance can be so expensive for some.

Make the right decisions for your health. Congenital conditions and bad luck account for some medical conditions. However, poor diet, lack of exercise, and other factors like overconsumption of alcohol, tobacco use, and neglecting treatment for certain conditions can lead to the development of serious health concerns.

Role of health insurance companies in cost escalation

Health insurance companies play a pivotal but complex role in the healthcare ecosystem, and their actions can contribute to the escalation of healthcare costs in several ways. Two key aspects to consider are profit margins and the business of health insurance, as well as the influence of risk pooling and adverse selection on premium pricing.

1. Profit Margins and the Business of Health Insurance:

Health insurance companies are profit-driven entities, and like any other business, they aim to generate revenue and maximize their margins. This inherent profit motive can lead to actions that impact healthcare costs, such as:

- Administrative Overhead: Health insurers often have substantial administrative overhead, including marketing, underwriting, and claims processing. These costs are passed on to consumers in the form of higher premiums, which can contribute to overall healthcare expenditure.

- Profit Expectations: Insurers need to meet profit expectations set by shareholders or stakeholders. To achieve this, they may increase premiums, limit coverage, or negotiate lower reimbursement rates with healthcare providers, potentially affecting access to care and healthcare costs.

- Risk Mitigation: Health insurance companies also engage in risk management to mitigate their financial exposure. This can lead to practices like denying coverage to individuals with pre-existing conditions or imposing high deductibles and copayments, which may discourage individuals from seeking necessary care.

2. Risk Pooling and Adverse Selection:

- Risk Pooling: Health insurance relies on the concept of risk pooling, where premiums from a large and diverse group of policyholders are used to cover the healthcare costs of those who need medical care. The idea is that healthy individuals subsidize the expenses of those with health issues, which helps make coverage more affordable for all.

- Adverse Selection: Adverse selection occurs when individuals with a higher likelihood of needing medical care are more likely to purchase insurance. For example, people with known health conditions may be more motivated to buy coverage, as they anticipate needing medical services. This can result in a sicker and more costly risk pool, prompting insurers to raise premiums to cover the expected higher healthcare costs.

- Premium Escalation: The interplay between risk pooling and adverse selection can lead to a cycle of premium escalation. As premiums rise due to a sicker risk pool, healthier individuals may be discouraged from purchasing coverage, further skewing the risk pool and perpetuating the cycle of increasing premiums.

Health insurance companies face a delicate balancing act between profitability and providing affordable coverage. To mitigate their role in healthcare cost escalation, regulatory measures, such as the Affordable Care Act in the United States, have been implemented to address issues like pre-existing condition exclusions and minimum coverage requirements. Additionally, ongoing efforts to enhance transparency, competition, and value-based care models aim to align the interests of health insurers with the broader goals of controlling healthcare costs while ensuring access to quality care.

Government regulations and policies

Government regulations and policies play a pivotal role in shaping healthcare systems and services, influencing accessibility, affordability, and quality of care.

Understanding government influence on insurance costs

Understanding how government influence impacts insurance costs and navigating the complex policy landscape is crucial for individuals and businesses seeking affordable and effective insurance solutions. Government regulations and policies have a profound impact on the insurance industry, affecting pricing, coverage options, and accessibility. This section delves into the multifaceted relationship between government actions and insurance costs, providing insights into how individuals and organizations can navigate these policy seas effectively.

Potential policy changes

Policy changes hold the potential to bring significant reform to the healthcare landscape and can have a profound impact on health insurance expenses. In this section, we explore the various possibilities for policy reform and examine how these potential changes can influence the affordability and accessibility of health insurance for individuals and businesses alike. Understanding the potential shifts in healthcare policy is essential for making informed decisions regarding health insurance coverage and expenses.

Controlling healthcare costs

In this section, we delve into the strategies and mechanisms currently in place to control healthcare costs and explore viable approaches for short-term cost containment. Understanding the factors and initiatives that influence the affordability of healthcare is essential in addressing the immediate challenges faced by individuals, organizations, and policymakers in the pursuit of accessible and sustainable healthcare solutions.

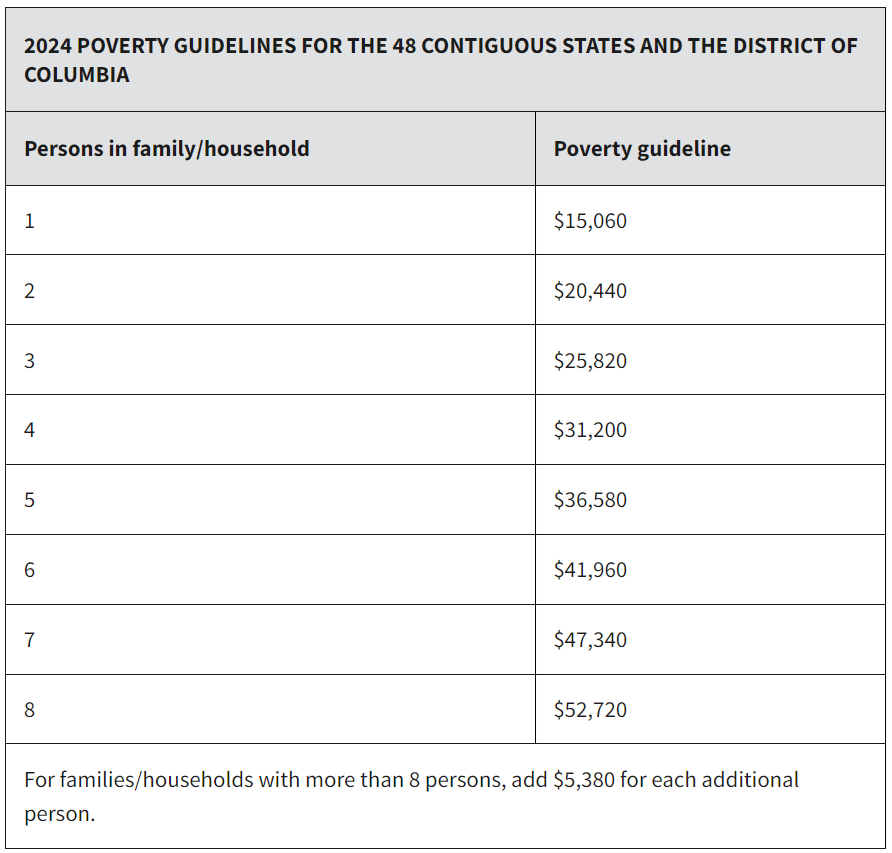

The FPL and the “subsidy cliff”

Those who make between 100% and 400% of the federal poverty line (FPL) may be eligible for ACA subsides to help pay their premiums and, in some cases, their out of pocket expenses (such as copayments and deductibles). If you fall outside of this, even if it’s just making 401% of the FPL, then you might find yourself falling off the subsidy cliff.

Those who make above 400% of the federal poverty line (FPL) and who aren’t eligible for premium tax credits are dealing with something called the “subsidy cliff”, which refers to how there is a steep drop off in government assistance. There is no subsidy phase out for those making 401% and above the FPL.

This means that people making just over 400% of the FPL are completely responsible for the full cost of their insurance premiums.

“If you qualify for Obamacare subsides, you may be happy with your health insurance premiums – but the fact is that, for some families, earing just a couple hundred dollars more per year can make you ineligible for subsides and raise your health insurance costs by thousands of dollars,” said eHealth CEO Scott Flanders. This means, those couple extra dollars could cost you hundreds, or even thousands, due to not getting subsidies for your ACA health insurance plan.

Shopping outside of state/federal marketplaces

If you find yourself falling off the subsidy cliff (or find that ACA insurance plans are too expensive for any other reason), you’re probably going to benefit from a private marketplace like eHealth. On our online marketplace, we offer ACA plans along with many other alternatives that you’ll likely find are more affordable. Keep in mind, a more affordable health insurance plan will likely mean less benefits are covered, but being covered by a plan with less benefits is probably a better option than not being able to afford health insurance at all. Whether it’s due to the subsidy cliff, or something else, many middle-income individuals and families are shopping outside of government exchanges to find their insurance.

Private exchanges – such as eHealth – offer a wider selection of health insurance plans than government exchanges. Some people may find they can save money by buying an off-market plan through a private exchange.

It takes as little as providing your zip code to get quotes on all different kinds of plans at eHealth. You’ll find that it’s incredibly easy to compare prices for plans with eHealth, in order to find something that is right for your health care needs and budget.

Opting for short term health insurance

Another option people are looking into is short term health insurance plans. These plans offer coverage for short amounts of time (only for up to three months, with the chance to renew for an additional month, depending on where you live) at a lower rate than most major medical plans.

Keep in mind that these plans offer less coverage than most major medical plans and may not cover the 10 essential benefits ACA plans are mandated by law to cover. If you didn’t have coverage during 2023, the fee no longer applies. This means you don’t need an exemption in order to avoid the penalty.

Potential long-term solutions for healthcare cost reduction

The rising costs of healthcare have been a persistent concern worldwide, and addressing this issue requires a multifaceted approach. In this article, we will explore potential long-term solutions for reducing healthcare costs, aiming to make healthcare more affordable and accessible for individuals and communities while maintaining or even improving the quality of care provided. These solutions encompass various aspects of healthcare delivery, financing, and policy, offering a comprehensive outlook on how we can achieve sustainable cost reduction in the healthcare sector.

Telemedicine and digital health

Innovations in care delivery, such as the widespread adoption of telehealth and digital medicine, have the potential to significantly lower healthcare costs by enhancing efficiency and accessibility. Telehealth enables patients to receive medical consultations and monitoring remotely, reducing the need for in-person visits and associated overhead costs. Additionally, digital health technologies, like wearable devices and health apps, empower individuals to actively manage their health and prevent costly complications through early intervention. Moreover, telehealth and digital solutions facilitate the integration of data-driven healthcare, allowing for more personalized and preventive care strategies that can ultimately reduce the overall burden on healthcare systems by addressing issues proactively and cost-effectively.

Policy reforms on the horizon

Addressing pharmaceutical pricing and administrative overhead are critical components of cost reduction in healthcare. To tackle pharmaceutical pricing, governments and healthcare organizations can explore policies like price negotiation, reference pricing, and generic drug promotion to create a more competitive and transparent market. Additionally, promoting research and development incentives for affordable generic and biosimilar alternatives can help lower drug costs. Administrative overhead reduction can be achieved through simplifying billing and claims processes, standardizing electronic health records (EHR) systems, and investing in interoperable health information technology. Streamlining administrative tasks not only cuts operational expenses but also frees up healthcare professionals to focus more on patient care, thereby improving overall healthcare efficiency while reducing costs. These combined efforts in pharmaceutical pricing reform and administrative efficiency can contribute significantly to the goal of making healthcare more cost-effective and accessible.

Public health initiatives

Public health initiatives, particularly those focused on promoting prevention, play a crucial role in combatting rising health insurance costs. By encouraging healthier behaviors and providing access to preventive services, such as vaccinations, screenings, and lifestyle counseling, these initiatives can reduce the incidence and severity of chronic diseases, which account for a significant portion of healthcare expenditures. A healthier population requires fewer medical interventions, hospitalizations, and costly treatments, resulting in lower overall healthcare expenses. Moreover, preventive measures can lead to early detection and intervention, preventing costly complications down the line. By investing in public health strategies that prioritize prevention, we can not only improve the well-being of individuals but also mitigate the financial strain on health insurance systems, ultimately contributing to more affordable and sustainable healthcare for all.

FAQs about the cost of health insurance

Here are some of the most frequently asked questions on why health insurance is so expensive.

How can I lower my health insurance costs?

When you hurt yourself or suffer an injury, take the time to determine the seriousness of the incident. Does it really warrant a trip to the emergency room? What about your prescription medication? Can you switch to generic brands to save money? Often, they have the same active ingredient without the high price tag. You can also make sure that you choose less expensive in-network health care providers whenever possible.

If you need a substantial change in your insurance costs, it may be worthwhile to shop around to find health insurance you can afford.

Can you negotiate health insurance costs?

You can’t really negotiate your costs, although that’s a common myth. However, you can try to lower your premiums. Taking a higher deductible is just one way you can lower your monthly premiums. Ask your insurance provider for additional ideas to save money.

Why is health insurance so expensive in the US?

Health insurance in the United States is marked by its exorbitant costs, which can be attributed to a combination of factors. A significant contributor is the excessively high administrative expenses associated with the complex, multi-payer system, which includes insurance companies, government programs, and healthcare providers. Additionally, the rapidly escalating prices of prescription drugs, driven by factors such as limited competition and pharmaceutical industry practices, place immense financial pressure on both insurers and patients. Poor lifestyle choices and the prevalence of chronic conditions, exacerbated by an aging population, lead to increased utilization of healthcare services, driving up costs further. These intricate factors collectively contribute to the ongoing challenge of making health insurance affordable for individuals and families in the United States.

Find affordable health insurance with eHealth

Now that you understand the reasons behind the high cost of US healthcare, you can take steps to reduce your monthly premiums. This may include shopping around for lower-cost insurance options, choosing generic drugs or brand-name ones, and making changes to improve your lifestyle. eHealth can help you find affordable individual and family health insurance as well as short-term health insurance for those transitioning from one job to another or facing other changes. Contact us today to find out how we can help you save money on your premiums.