Individual and Family

What Is Private Health Insurance?

Published on July 11, 2024

Share

It’s perfectly understandable if you are asking yourself questions such as “What is private health insurance?” or “What’s the difference between private vs. public insurance?” or “What do I have (or should I have) private healthcare coverage or public health insurance?” Let’s take a closer look at health insurance so that you can make informed decisions about your health insurance options. Then you can move forward with confidence to choose a plan that meets your needs.

Private health insurance refers to health insurance plans marketed by the private health insurance industry, as opposed to government-run insurance programs. Private health insurance currently covers a little more than half of the U.S. population.

Types of private health insurance

Private health insurance encompasses various types of coverage tailored to individuals, families, and groups. Here’s an overview of the most common types:

- Individual Health Insurance: This type of policy is designed for a single person and provides coverage solely for the policyholder. It offers a range of benefits based on the chosen plan and insurer.

- Family Health Insurance: Family health insurance plans cover multiple family members, typically including a spouse and dependent children. It offers the convenience of a single policy covering the entire family.

- Group Health Insurance: Group health insurance is provided by employers to their employees. It’s designed to cover a group of people, often with lower premiums than individual plans due to group purchasing power.

- Medicare Advantage (Medicare Part C): Medicare Advantage plans are offered by private insurers as an alternative to traditional Medicare (Part A and Part B). These plans often include additional benefits like prescription drug coverage (Part D) and may have lower out-of-pocket costs.

- Short-Term Health Insurance: Short-term health insurance provides temporary coverage for individuals who experience a coverage gap, such as during a job transition. It offers limited benefits and is typically intended for short periods, usually up to 12 months. Short-term health insurance is not a generally a substitute for comprehensive major medical plans because they do not provide essential medical benefits such as preventive care, coverage of pre-existing conditions, pregnancy or childbirth, or mental health and substance abuse.

- Catastrophic Health Insurance: Catastrophic plans are designed for young, healthy individuals who want to protect themselves against major medical expenses. They have low premiums but high deductibles and mainly cover severe health events, like accidents or serious illnesses.

- Supplemental Health Insurance: Supplemental insurance policies are used to complement existing health coverage. These policies, such as critical illness or hospital indemnity insurance, provide additional financial support for specific medical situations. These plans are not generally a substitute for comprehensive major medical plans because they do not cover pre-existing conditions or provide essential medical benefits such as preventive care, pregnancy or childbirth, or mental health and substance abuse.

- Dental and Vision Insurance: These policies cover dental and vision care expenses, such as routine check-ups, eyeglasses, or dental procedures. They are often offered as standalone plans or as part of comprehensive health plans.

- Long-Term Care Insurance: Long-term care insurance covers expenses related to extended care, such as nursing homes, assisted living facilities, or home healthcare. It helps individuals prepare for the financial burdens of long-term care.

- Travel Health Insurance: Travel health insurance offers coverage for medical emergencies and healthcare expenses when traveling internationally. It may include coverage for trip cancellations, medical evacuations, and more. These plans generally do not cover pre-existing conditions or provide essential medical benefits such as preventive care, pregnancy or childbirth, or mental health and substance abuse.

- Specific Disease or Illness Insurance: These policies focus on providing coverage for specific diseases or conditions, such as cancer insurance. They offer financial assistance for treatments and related expenses.

- High-Deductible Health Plans (HDHPs): HDHPs are health insurance plans with high deductibles and lower premiums. They are often paired with Health Savings Accounts (HSAs) to help individuals save for healthcare costs.

Each type of private health insurance has its advantages and limitations, so choosing the right plan depends on an individual’s or family’s specific healthcare needs, budget, and preferences. Consulting with an insurance advisor can help navigate the options and make an informed decision.

Individual health insurance

Individual health insurance may be your best option in these circumstances:

- If you are single or if your spouse’s private group health insurance coverage is unavailable or unaffordable, and

- You recently lost your job and your employer-sponsored group health insurance, and you cannot afford COBRA (Consolidated Omnibus Budget Reconciliation Act).

- COBRA allows eligible former employees and their dependents the option to continue group health insurance coverage at their own expense for a period of time, usually up to 36 months. It can be expensive, especially if the plan provides comprehensive coverage, including prescription, vision, and dental.

- You are self-employed.

- You work part-time and you are not eligible for your employer’s group health insurance.

- You are turning age 26 when you will no longer be covered as a dependent on your working parent’s private health insurance plan.

- Your spouse (or parent) enrolls in Medicare and you lose dependent coverage when the private health insurance plan terminates.

Family health insurance

Family health insurance is a type of healthcare coverage that provides medical benefits to all members of a family under a single insurance policy. These policies typically cover the primary policyholder, their spouse, and dependent children, with some plans extending coverage to other dependents like domestic partners or stepchildren. Family health insurance offers comprehensive benefits, including doctor’s visits, hospital stays, prescription drugs, preventive care, maternity care, and emergency services. The cost of premiums, deductibles, copayments, and coinsurance is shared among the covered family members, often making it more cost-effective than individual plans.

One of the primary advantages of family health insurance is the convenience of having all family members covered under a single policy. This simplifies administrative tasks such as premium payments and claims processing. These plans often come with a network of preferred healthcare providers, which can result in lower out-of-pocket costs for those who stay within the network. Family policies usually cover dependent children up to a certain age, typically 26 years old, regardless of their financial dependence status. Preventive care services, like vaccinations and screenings, are often included at no additional cost to promote overall wellness.

Families can sometimes customize their coverage by adding optional benefits, such as dental insurance, vision insurance, or additional coverage tailored to specific family members’ needs. It’s essential to carefully assess your family’s healthcare needs, budget, and preferences when choosing a family health insurance plan. Evaluating the plan’s details, provider network, and cost-sharing structure will help ensure it aligns with your family’s requirements. Additionally, families may be eligible for government subsidies or tax credits to reduce the cost of their health insurance if they purchase it through a government-sponsored health insurance marketplace.

Group health insurance

Group health insurance is a type of health coverage provided by employers or organizations to their employees or members. It is designed to offer medical benefits to a group of people, typically employees within a company or members of an organization, under a single insurance policy. Group health insurance is a common employee benefit and a way for organizations to attract and retain talent while promoting the well-being of their members.

Here are some key characteristics of group health insurance:

- Coverage for a Group: As the name suggests, group health insurance covers a defined group of individuals, such as employees of a company or members of a professional association.

- Shared Costs: The costs of group health insurance are often shared between the employer or organization and the covered individuals. Employers may pay a significant portion of the premiums, making it more affordable for employees.

- Comprehensive Benefits: Group health plans typically offer comprehensive benefits, including doctor’s visits, hospital stays, prescription drugs, preventive care, and other essential medical services.

- Negotiated Rates: Insurance providers often negotiate rates with healthcare providers and facilities, resulting in potential cost savings for both the insurer and the insured.

- Enrollment Periods: Employees or members typically enroll in group health insurance during specified enrollment periods, such as during their onboarding process or during annual open enrollment.

- Provider Networks: Group health plans may have preferred provider networks, which encourage members to seek care from a network of healthcare providers, leading to cost savings.

- Uniform Coverage: All eligible employees or members receive the same base coverage, although there may be options to customize coverage based on individual needs.

- Tax Benefits: Both employers and employees may enjoy tax benefits related to group health insurance premiums, making it an attractive option for many.

- Regulations: Group health insurance is subject to regulations and requirements, including those outlined in the Affordable Care Act (ACA), to ensure that essential health benefits are provided.

Group health insurance provides a sense of security and financial protection to employees or members and their families. It can also contribute to better overall health outcomes by ensuring that individuals have access to necessary medical care. Employers and organizations often collaborate with insurance providers to select the most suitable group health insurance plan that meets the needs of their employees or members while managing costs effectively.

Medicare Advantage

Medicare Advantage, often referred to as Medicare Part C, is a type of private health insurance plan offered as an alternative to Original Medicare, which includes Medicare Part A (hospital insurance) and Part B (medical insurance). These plans are available through private insurance companies that have been approved by Medicare. Medicare Advantage plans aim to provide comprehensive healthcare coverage and often include additional benefits beyond what Original Medicare offers.

Here are some key points about Medicare Advantage plans:

- Coverage Options: Medicare Advantage plans typically offer all the benefits of Original Medicare (Parts A and B) and often include prescription drug coverage (Part D). In addition to these basic benefits, many Medicare Advantage plans may cover services like vision, dental, hearing, and wellness programs.

- Managed Care: These plans often operate under managed care models, such as Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). These networks of doctors, hospitals, and other healthcare providers are contracted with the insurance company to offer services to plan members.

- Cost Structure: Medicare Advantage plans may have lower monthly premiums than Original Medicare, but they often require cost-sharing in the form of copayments, coinsurance, and deductibles. The overall cost structure can vary depending on the specific plan.

- Extra Benefits: Many Medicare Advantage plans offer additional benefits like gym memberships, telehealth services, and preventive care at no extra cost. These extras can vary by plan and insurance provider.

- Annual Changes: It’s important to note that Medicare Advantage plans can change from year to year. This includes changes in premiums, benefits, and provider networks. It’s advisable for beneficiaries to review their plan during the annual Medicare Open Enrollment Period to ensure it still meets their needs.

- Prescription Drug Coverage: Most Medicare Advantage plans include prescription drug coverage (Medicare Part D). This can be convenient for individuals who want an all-in-one healthcare plan.

- Network Restrictions: Depending on the plan type, beneficiaries may be required to use a network of doctors and hospitals. HMOs, for example, typically have more restrictive networks, while PPOs offer more flexibility to see out-of-network providers at a higher cost.

- Out-of-Pocket Maximum: Medicare Advantage plans have an out-of-pocket maximum, which limits the amount a beneficiary can spend on covered healthcare services in a year. Once this limit is reached, the plan covers all additional costs for the remainder of the year.

Short-term Health Insurance

Short-term health insurance may be a good fit if you only need coverage for a temporary period. For example, you may be one form or another of transition. Perhaps you are between jobs. Maybe you are recently divorced. Possibly you or your spouse retired, and you have a short wait before you are eligible to enroll in Medicare. Any of these transitional circumstances could make short-term health insurance an affordable option. Generally short-term policies provide coverage for 3 months or less, with the potential for an additional month renewal.

This temporary, limited policy offers fewer benefits and federal protections compared to more comprehensive health insurance options available on HealthCare.gov. It may exclude coverage for preexisting conditions such as diabetes, cancer, stroke, arthritis, heart disease, and mental health and substance use disorders. Additionally, the policy might not cover essential health services including prescription drugs, preventive screenings, maternity care, emergency services, hospitalization, pediatric care, and physical therapy. There is often no cap on what you pay out-of-pocket for care, and you won’t qualify for federal financial assistance to help with premiums and out-of-pocket costs. Furthermore, this type of insurance does not need to meet federal standards for comprehensive health coverage.

Catastrophic Health Insurance

If you are young and healthy, you may consider catastrophic insurance. A catastrophic policy is available to a limited number of people: generally for adults under age 30; older adults can buy a catastrophic plan if no other qualified health plan offered through the marketplace in 2022 would cost less than 8.09% of their income and they qualify for a “hardship exemption.”

Catastrophic insurance premiums are very inexpensive. While catastrophic coverage offers the same benefits as qualified health plans on the marketplace/exchange, you must meet a very high deductible ($8,700 in 2022, which increases to $9,100 in 2023) before the plan pays for most covered services. The plan will pay for preventive care doctor visits (limited to 3 in the year) before you meet the plan’s deductible.

Benefits of private health insurance

Private health insurance offers several advantages that can enhance your healthcare experience. Here are some key benefits:

- Choice of Doctors and Hospitals: With private health insurance, you often have a broader choice of healthcare providers. You can select doctors, specialists, and hospitals based on your preferences and healthcare needs. This flexibility allows you to receive care from professionals you trust and are comfortable with.

- Comprehensive Coverage Options: Private health insurance plans come in various tiers and coverage levels, allowing you to choose a plan that best suits your healthcare needs and budget. These plans typically cover a wide range of medical services, including hospital stays, doctor’s visits, preventive care, prescription drugs, and more. Some plans also offer additional benefits like dental, vision, and mental health coverage.

- Faster Access to Healthcare Services: Private health insurance often provides quicker access to healthcare services. You can typically schedule appointments with specialists and undergo medical procedures more promptly than relying solely on public healthcare systems. This can be especially important when you need immediate care or consultations.

- Access to Advanced Treatments: Private health insurance plans may cover advanced and innovative treatments that may not be available through public healthcare programs. This access to cutting-edge medical therapies and technologies can be critical for individuals with complex or rare medical conditions.

- Reduced Wait Times: Private insurance can help reduce wait times for elective surgeries and specialized treatments. Public healthcare systems may have longer waitlists for certain procedures, while private insurance can expedite access to these services.

- Coverage for Additional Services: Many private plans offer coverage for services not typically covered by public healthcare, such as chiropractic care, alternative therapies, and wellness programs. This can contribute to your overall health and well-being.

- Personalized Customer Support: Private insurers often provide dedicated customer support to assist you with claims, billing, and any questions or concerns you may have about your coverage. This personalized assistance can streamline the administrative aspects of healthcare.

- Choice of Plan Features: Private health insurance allows you to tailor your coverage to your specific needs. You can choose from various plan options, such as Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and High Deductible Health Plans (HDHPs), each offering different cost structures and provider networks.

- Portability: Private health insurance is typically portable, meaning you can maintain coverage even if you change jobs or move to a different location. This continuity of coverage can provide peace of mind and financial stability.

- Additional Benefits: Some private health insurance plans offer wellness incentives, such as gym memberships, health screenings, and discounts on health-related products and services.

While private health insurance offers many advantages, it’s essential to carefully review and compare plans to find the one that aligns with your healthcare needs, budget, and preferences. Additionally, the availability of private insurance options may vary by location and insurer, so it’s advisable to explore the plans available in your area.

How is private health insurance different than public insurance

Public health insurance is government-sponsored. The federal government, state government, or a combination of state and federal government runs these health insurance programs. Public health insurance programs are funded largely from tax-payer dollars put in trusts that are used to pay eligible medical expenses and or the cost of prescription drugs. Public health insurance is available to some U.S citizens and permanent legal aliens. In addition to military and Native American Indian health insurance, the three of the most common public health insurance options include Medicare, Medicaid, and CHIP

Potential cost savings

Insurance companies set their premiums. Premiums are the price (usually monthly) you pay in exchange for coverage by the insurer’s plan. States typically set caps on how much insurance companies can raise premium rates each year. The cost to purchase private health insurance –that is, the premium—varies widely. Factors that influence premium cost include:

- the private health insurance plan you choose (how comprehensive the coverage is and how much you share in the cost for covered services),

- the insurer you choose,

- the number of individuals covered under the plan, and

- the region in which the plan is purchased.

For individual purchasers, age and tobacco status also factor into the cost of coverage.

For people who get their private health insurance through an employer, employers tend to cover at least 50 percent of the premium costs. Usually these are pre-tax dollars, which often reduce taxes for those who are covered by the plan. Those who purchase their private health insurance on the marketplace/exchange may find they are eligible for premium tax credit subsidies and other cost-sharing reductions.

When might you need to buy private health insurance?

If you are not enrolled in an employer-sponsored private health insurance plan through your work or a spouse’s employer, and you aren’t eligible for public health insurance, such as Medicare or Medicaid, you will need to purchase private health insurance. You have many choices. Your particular circumstances may make one type of private health insurance more attractive than another. Take a look at three of the most common options in private health insurance for individuals and their families.

The enrollment process for private health insurance can vary depending on the insurer and the type of plan you choose. However, here is a general overview of the steps involved in enrolling in private health insurance:

- Research and Compare Plans:

- Begin by researching and comparing health insurance plans available in your area. You can do this through insurance company websites, healthcare marketplaces, or by working with an insurance broker or agent. Consider factors such as coverage options, premiums, deductibles, and network providers.

- Determine Eligibility:

- Ensure that you meet the eligibility criteria for the health insurance plan you wish to enroll in. Eligibility requirements can vary, but typically, you must be a legal resident of the country or state where the plan is offered.

- Gather Personal Information:

- Prepare the necessary personal information and documents. This may include your Social Security number, date of birth, employment details, and information about any dependents you wish to include on the plan.

- Open Enrollment Period:

- Private health insurance plans often have specific enrollment periods during which you can apply for coverage. The most common enrollment period is the annual Open Enrollment Period (OEP), which typically occurs in the fall. During OEP, you can apply for new coverage, renew existing coverage, or make changes to your plan.

- Special Enrollment Period (SEP):

- If you experience a qualifying life event, such as getting married, having a child, or losing other coverage, you may be eligible for a Special Enrollment Period. SEPs allow you to enroll in or make changes to your private health insurance outside of the standard OEP.

- Apply for Coverage:

- Complete the application for the selected health insurance plan. You may do this online, by phone, or through a paper application, depending on the insurer’s preferred method. Provide accurate and detailed information to ensure your application is processed correctly.

- Review Plan Options:

- Once you submit your application, you will typically receive a selection of available plan options. Review these options carefully, considering factors like monthly premiums, deductible amounts, copayments, and coverage benefits.

- Select a Plan:

- Choose the health insurance plan that best meets your healthcare needs and budget. You may also need to select a primary care physician (PCP) if your plan requires it.

- Pay Premiums:

- Pay your initial premium to activate your coverage. This payment is typically required before your coverage becomes effective.

- Receive Confirmation:

- After completing the enrollment process and making the initial premium payment, you will receive confirmation of your health insurance coverage. This may include an insurance ID card and a welcome packet.

- Utilize Your Coverage:

- Once your coverage is active, you can begin scheduling healthcare appointments, visiting healthcare providers, and using your insurance benefits as needed.

- Annual Renewal:

- Private health insurance plans usually require annual renewal during the Open Enrollment Period. Review your plan each year to ensure it continues to meet your needs, and make any necessary changes.

If you purchase insurance through the marketplace/exchange, you may be eligible for Affordable Care Act subsidies such as premium tax credits or cost-sharing reductions, which can substantially lower your private healthcare costs. The marketplace is an online platform that offers insurance plans to individuals, families, and small businesses. It is run by the federal government, or state government, or through a partnership of both. Keep in mind, however, this is private health insurance, even though the marketplace/exchange for purchasing subsidized or unsubsidized health insurance is government-run. You can also purchase private health insurance through an insurance agent or broker or directly from an insurance company. In these instances, though, you won’t be eligible for subsidies.

Who regulates private insurance?

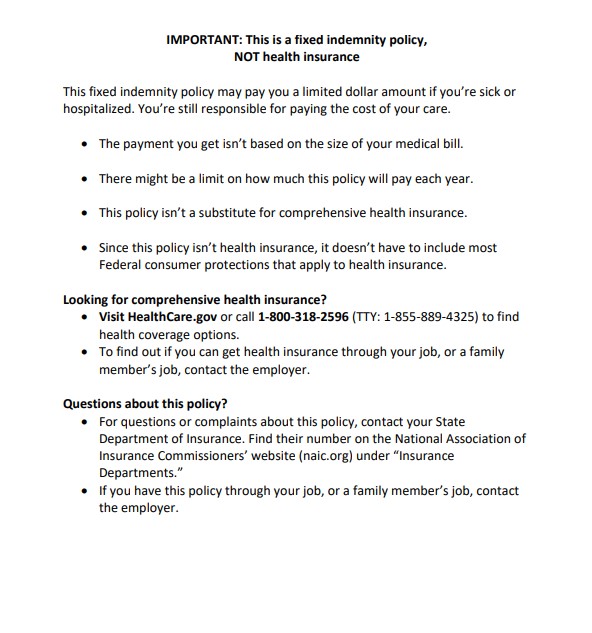

While it is not run by the government, private health insurance is highly regulated at both the state and federal level. Regulations and laws often address what healthcare services must be covered by group and individual health plans. For example, maternity coverage and mental health parity are just two of the long-standing regulatory requirements for private employer-sponsored group health plans. Also most employer-sponsored private health insurance plans and individual/family plans purchased by consumers offer benefits that meet the minimum essential coverage requirements of the Affordable Care Act (ACA; also known as Obamacare). Other plans, such as short-term, fixed indemnity, vision, dental, and critical illness policies offer benefits, usually at a low cost, but they are not as comprehensive as ACA-compliant medical plans (meaning they exclude many types of coverage, including the minimum essential benefits of the ACA), and they do not count as a qualified health plan under the ACA.

Advantages of working with eHealth

Let eHealth help you navigate your private health insurance choices today at no extra cost! We offer you 24/7 access to review a broad range of private insurance plans –both on and off the marketplace/exchange – and available where you live. You can compare cost and coverage online and in the convenience of your home. But if you want expert assistance, one of our licensed insurance agents can answer your questions and help you find a policy that provides the coverage you need at an affordable price See what health insurance plans are available today!